Winning Trust and Awards: AI-Powered Insurance Experiences Designed for People

This case study features work created under my leadership at American Family Insurance, which was made public under executive direction and has been shared with various trade organizations and at conferences starting in 2024. All views are my own.

As a design leader at American Family Insurance, I challenged the industry's narrow focus on AI-driven efficiency. I directed my team to prioritize impact on the customer experience, knowing that if we got that right, profitability would follow.

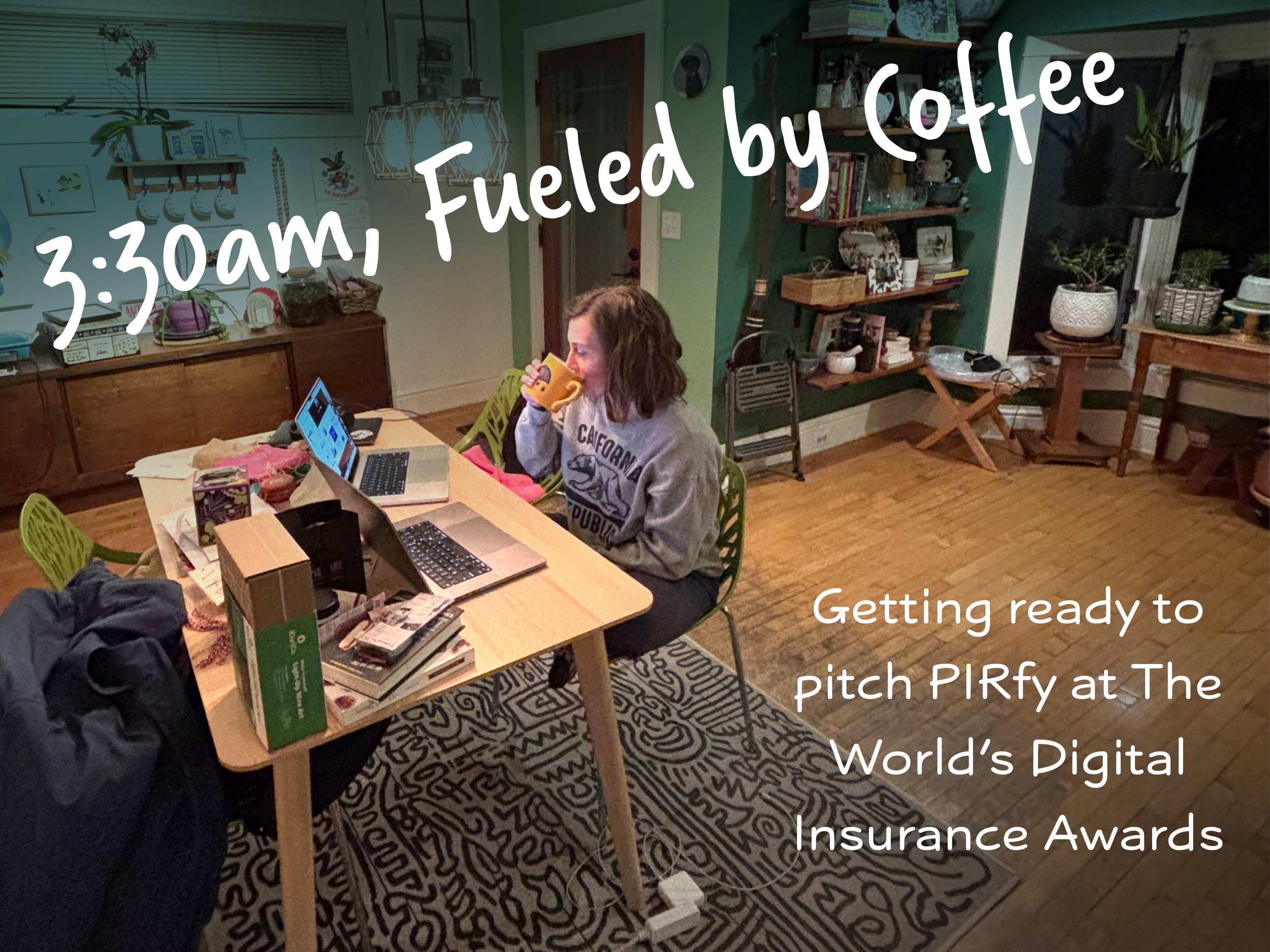

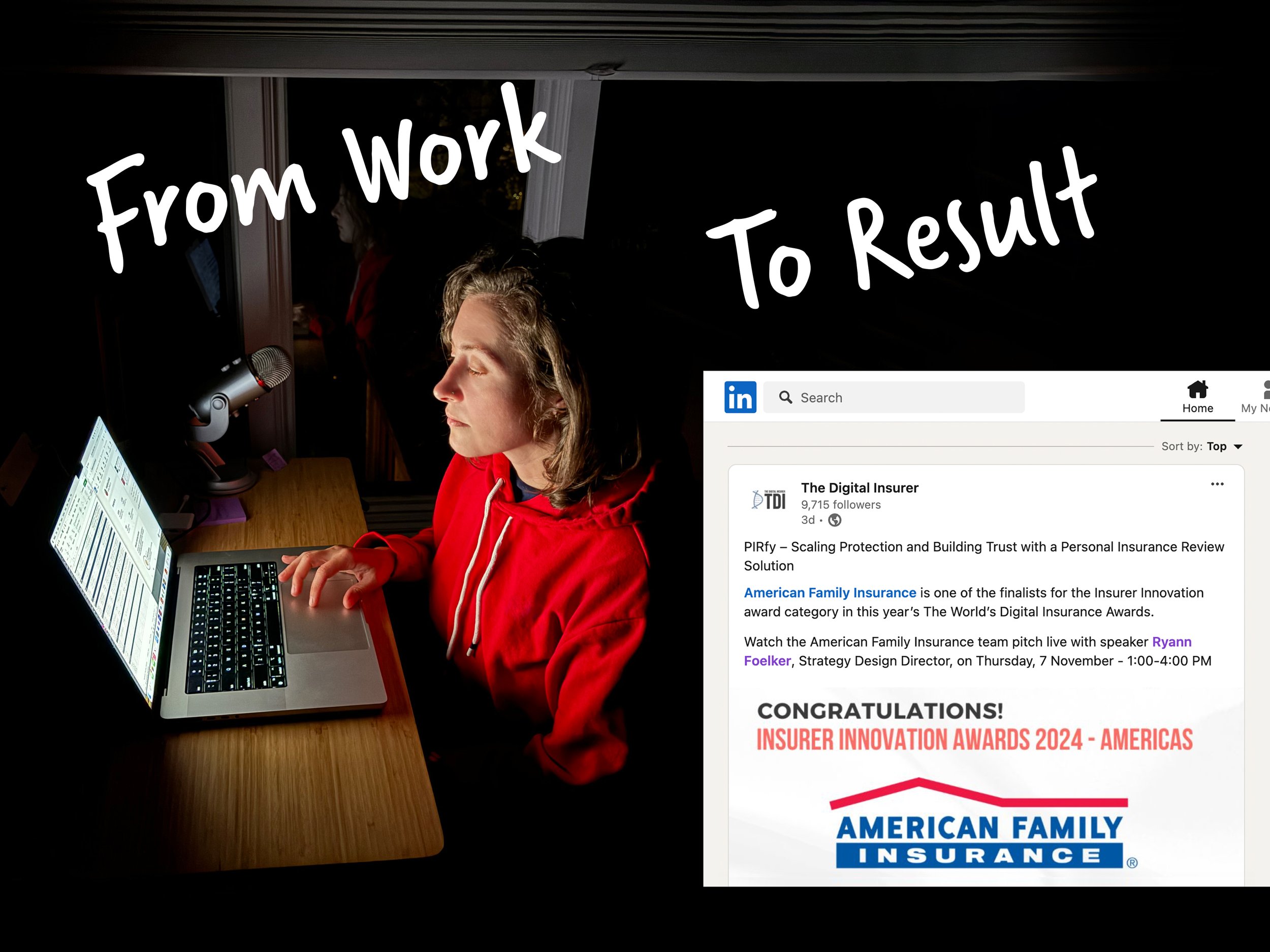

This approach led to PIRfy, an agent-facing solution designed by Monica Gengler that helps prepare and personalize customer insurance reviews. PIRfy earned American Family Insurance the 2024 Insurer Innovation Award and is projected to have a significant impact on revenue following its scaled release.

To achieve this, I created a seven-week "Design School Challenge" to teach my team how to design solutions using generative AI to solve the real-world challenges people face with insurance. The impact of this effort was recognized by Reuters, who named me one of their 2025 Trailblazing Women in Insurance.

From Design to Distinction

At American Family Insurance, I shifted the focus from profits to people, knowing that truly valuable products lead to lasting financial success, just like Google’s free search engine. The Design School Challenge allowed me to guide my team through the design of AI-powered insurance solutions, resulting in cool opportunities and recognition.

The Challenge: An Industry Stuck on Efficiency

The insurance industry's initial response to advanced AI was, frankly, underwhelming. Conversations focused on efficiency, prioritizing speed and cost reductions. This is typical of technology-driven innovation: tech experts decide what to build and business consultants recommend ways to use it. It’s effective, but it often overlooks the real issues people face. To create products people love, you need to understand how people feel. The industry was all about faster, cheaper insurance; I wanted better insurance for everyone.

As the sole design leader at American Family Insurance (and one of few in the insurance industry) my approach to innovation is shaped by lessons from my industrial design mentor, Tom. Early in my career, Tom taught me a structured design process to solve real-world problems using specific manufacturing capabilities. Tom’s approach to creating new products using rotational molding reshaped my entire perspective on product design: it wasn’t just about solving problems; it was also about maximizing the benefit of specific capabilities in your solutions.

The concept I developed for that assignment — a safe, affordable swim platform — demonstrated this approach by addressing a real problem with rotational molding’s unique features: low tooling costs, tons of shape and size flexibility, and consistent wall thickness. Essentially, I created an original “use case.” Inspired by this memory, I launched the Design School Challenge at American Family Insurance. Just as Tom guided me, I aimed to guide my team, recognizing that generative AI could offer personalized support to help solve some of the biggest problems customers face with money and insurance.

The Design School Challenge was my gift to the designers on my team and a love letter to the American people, who deserve more relevant and understandable financial service products. It started my efforts to scale a design-led approach to “use case” creation, advancements to insurance offerings using specific technological capabilities.

“When generative AI showed up, it was like a magic wand, with powers we'd never seen before. Why use that power to fix little problems when there are so many big Problems to solve?”

— Ryann Foelker

There are problems, and then there are Problems.

In the insurance world, I kept hearing about the problems: Customers might talk to a different person each time they call, have to explain things over and over, or wait too long for help. Those are real issues, and they need to be fixed.

But what I wasn't hearing about were the Problems customers face with insurance. The confusion, the lack of emotional connection with the products and companies, the difficulty of getting ready for bad weather – those are the big things holding people back. That's why I created the Design School Challenge: to teach my team how to use generative AI to help solve these Problems.

-

Insurance is confusing for most people. It's not just a feeling; the data proves it. Over half of Americans struggle to determine what policies they even need. And even when people think they understand their coverage, a shocking number are actually incorrect or unsure about the specifics.

It's no wonder. Insurance policies are filled with jargon, exclusions, and complex terms that can feel like a foreign language. It's the kind of stuff that makes you nod off, not feel empowered to make smart financial decisions.

That confusion highlights a growing disconnect with financial well-being — a Problem. And when people don't understand something, they're less likely to value it, less likely to trust the institutions selling it, and ultimately, more vulnerable to financial hardship.

-

Beyond the confusion, there's the harsh reality of affordability. While most Americans have some insurance, it's often not a top financial priority. In fact, fewer than one in five see comprehensive coverage as essential.

The Problem is that insurance is often viewed as a cost, not an investment – and don't get me started on companies that reinforce this view with their ads. People are constantly weighing it against other needs, sometimes literally choosing between insurance and shoes. And in today's world, with rising costs, that pressure is only growing.

The result is that people often opt for lower premiums, sacrificing proper coverage and increasing their financial risk.

-

People don’t interact with their insurance regularly. It's not a consistent relationship; it's more like a series of sporadic events.

Most people only interact with their insurance company when paying their bill, renewing their policy, or filing a claim. There aren’t many opportunities to build a relationship, which results in disconnect.

Because people don't think about their insurance regularly, they're less likely to understand their coverage, be prepared for risks, or feel an emotional bond. And that's a real Problem, because insurance is about protecting people’s financial health. If they're not engaged and informed, they're more vulnerable when something goes wrong.

-

Climate change is creating a perfect storm for insurance and the people it protects. More frequent and severe weather events mean greater risk, while insurance premiums rise and coverage becomes harder to find, especially in high-risk areas.

This Problem creates a vicious cycle: as climate risks increase, insurance becomes less accessible. And too often, people dismiss proactive severe weather planning, thinking, 'that's what I have insurance for.'

The reality is, insurance remains reactive, not proactive. This highlights a key disconnect: people rely on insurance to solve problems that better planning could mitigate.

-

Here's the thing about insurance: it's built on trust, but often bought without connection. People may generally trust their insurance – believing it will help if something bad happens – but that's not enough for loyalty.

And loyalty matters. The problem is, most insurance companies offer pretty much the same products. Loyalty is what keeps customers from jumping ship, but it's hard to build without a product that inspires an emotional connection.

Do you feel connected to your insurance? Do you feel like it was designed with care for your well-being? Or is it just a commodity, where one policy is as good as another?

That lack of emotional connection and unique value is a Problem. It means customers are less likely to stick around when things get tough. And in an industry built on promises, it signals an alarming lack of trust.

The Work: Cultivating Design-Led AI Innovation

The Design School Challenge was my opportunity to share a new approach to use case design, one that set AmFam up to tackle the Problems people face with financial services. The truth is, these Problems are interconnected, meaning solutions can be designed to address several at once. The trick is to create solutions that gently guide people toward healthier habits, rather than overwhelming them with hard-to-follow advice.

To achieve this, I laid out a structure that encouraged curiosity, creative problem-solving, and deep customer empathy. Over half of my team started their careers in insurance claims, and each one brought uniquely valuable insights into people’s relationship with insurance products. Each team member was responsible for their own unique concept, but they were also accountable for the value of the collective output.

This iterative, collaborative approach, balancing individual work with regular group feedback, was key to our success. This helped my team understand AI's capabilities and apply them strategically to address real-world challenges people face with money and insurance.

The resulting concepts showcased inventive, customer-focused AI insurance solutions. The design process encouraged learning, adaptation, and the development of valuable, innovative solutions, which then underwent further development and testing, illustrating a true design-led approach to industry-specific AI innovation.

The Design School Challenge was a seven-week project designed to teach my team how to create human-centered AI solutions for the insurance industry.

Weeks 1–3 (Exploration and Ideation): I encouraged my team to explore AI's potential and dig into customer pain points across the entire insurance value chain, imagining new, creative solutions free from the distraction of immediate business goals. Frequent feedback sessions expanded their view of what was possible and refined their perspective on customer problems.

Weeks 4–6 (Concept Refinement): With a clear definition of customer problems and an expanded view of what was possible with both insurance and generative AI, I led my team into concept development. Each person began to integrate technical feasibility into their ideas within the context of American Family Insurance, developing business models, and constantly iterating based on feedback.

Week 7 (Final Presentation): Each team member pitched his or her developed concept, emphasizing storytelling to clearly articulate the product's value to the user, the size of the opportunity, and the projected impact on American Family Insurance. The concepts were then evaluated for further development, where PIRfy emerged as the first to advance past proof-of-concept to development.

Most insurance solutions focus on streamlining the backend, neglecting the value of insurance itself. To prioritize the customer, I created the Design School Challenge, which led to PIRfy – designed to enhance the often-overlooked ‘bonding’ portion of the customer value chain.

The Lesson: From Burden to Benefit with Trojan Horse Products

Leading the Design School Challenge at American Family Insurance was a pivotal moment. While I set out to teach others how to design valuable solutions by maximizing AI capabilities, I solidified a theory about financial services I'd been developing for years. The challenge underscored the sheer scale and complexity of the issues facing everyday Americans – from climate change and rising costs to information overload and distrust in the insurance industry.

It's clear that traditional solutions aren’t working. Financial services companies need to break through the noise and engage people in a way that feels supportive. That's where the concept of 'Trojan Horse' products comes in.

These products address immediate needs and offer clear benefits while subtly incorporating support and education. Like a spoonful of sugar to help the medicine go down, 'Trojan Horse' products make financial wellness more accessible. PIRfy exemplifies this approach. It streamlines insurance reviews for agents while enabling a more engaging and personalized experience for customers, fostering stronger bonds and supporting financial literacy.

By prioritizing customer value, we can build trust, foster engagement, and ultimately create a more resilient and financially secure future for everyone. When people take their medicine, society gets healthier.