Designing Transformation: Innovative Operations for Better Experiences.

This case study features some of my work at American Family Insurance, which was made public under executive direction and has been shared in various industry publications and at conferences starting in 2021. All views are my own.

After four acquisitions, I led a team at American Family Insurance to envision the future of insurance claims. We successfully aligned five distinct claims processes, achieving over 20% in operational cost savings while enhancing our organization's capability to test and scale groundbreaking technology. Furthermore, we became the first top 20 carrier to operate on a single technology platform and the only carrier on Fast Company’s prestigious Best Workplaces for Innovators top 100 list.

To achieve this, my team and I developed a clear vision of what the company could accomplish with unified claims operations, along with an actionable roadmap and a compelling communication plan to secure buy-in and alignment at every level.

Utilizing a collaborative, human-centric approach, combined with my extensive design background, I led the team in creating innovative solutions to meet the needs of both adjusters and customers — solutions that could only be realized through streamlined claims operations.

The vision we conceptualized balanced human support with financial stability, gaining broad support for transformation and advancing American Family Insurance’s digital future.

Connected Claims USA Conference

“The work I led at American Family Insurance proves that design leadership can redefine any industry. It isn’t just beneficial—it’s essential for a better future.”

Designing a Multimillion Dollar Advantage

A bold vision inspires people to make bold choices, and the alignment around our vision made the decision-making process significantly faster. The investment to unite five separate claims operations on a single technology platform was readily approved. Work to modernize the claims infrastructure started right away.

This was the foundational first step toward realizing our vision for the future of claims — like the Brussel sprouts you have to eat before you’re allowed dessert. This step unlocked a temporary first-mover advantage, but true transformation started when we launched Fabric, a tech solution conceived in our visioning work, and Demo Days, a program to source, test, and scale Insurtech innovations.

My leadership sparked the successful digital transformation at American Family Insurance, demonstrating the impact of integrating design into every level of business strategy.

With my help, American Family Insurance became the first top 20 carrier on a single technology platform and the only one on Fast Company’s Best Workplaces for Innovators top 100 list.

We upgraded the organization’s ability to test and scale innovative technology and saved over 20% in operational costs. This multimillion-dollar expense advantage, realized every year the competition failed to catch up, helped fund the next phase of innovation.

Insurance AI and Innovative Tech Conference

“I need a strategic vision for the future of claims, a plan to present to the board in four months. Earlier attempts have failed. Can you help?”

The Challenge: Reimagine Insurance Claims in the Digital Age

American Family Insurance needed a better way to handle claims after four acquisitions during the rapid digital transformation of the industry. To improve customer interactions and reduce expenses, the company needed a clear vision for its future and a plan to get there.

The goal was to design a unified technology platform supporting innovative solutions and integrations with other systems. But this required a redesign of their (complex!) claims workflows—a far more difficult task. The platform and the new workflows needed to be able to adapt over time, allowing the company to persistently improve experiences for customers and employees.

This presented a two-fold challenge:

Envision the future of claims and create a roadmap to get there.

Get the buy-in and corporate alignment required for true transformation.

One claims leader recognized the challenges and the need for a different approach. He came to me and said, “I need a strategic vision for the future of claims, a plan to present to the board in four months. Earlier attempts have failed. Can you help?”

The Work: Designing the Future of Claims

Challenge #1: Envision the future of claims and create a roadmap to get there.

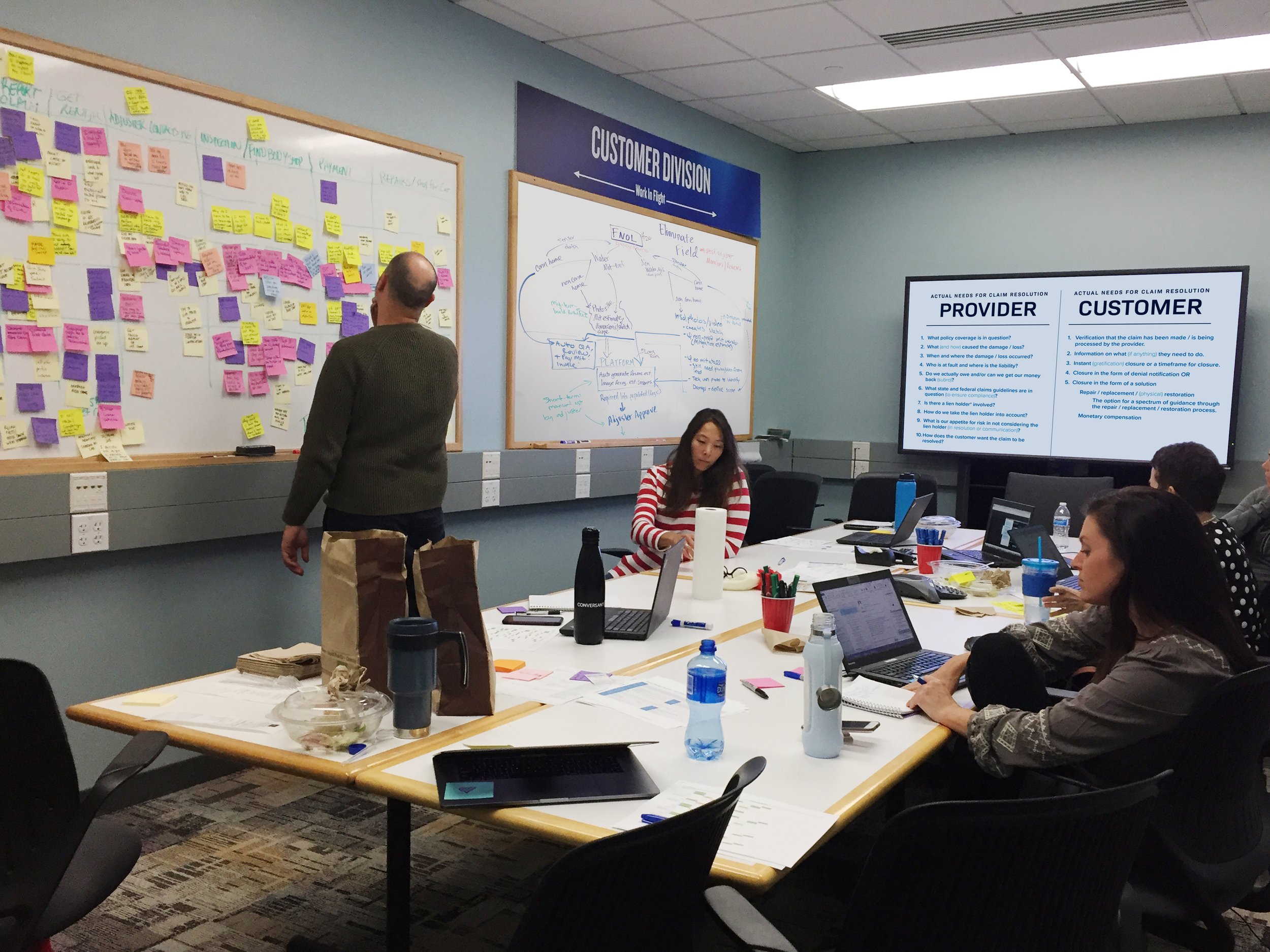

I was given a dedicated team of claims leaders and insurance experts. With four months already ticking away, we had to complete the vision and the roadmap before preparing a compelling presentation for board buy-in.

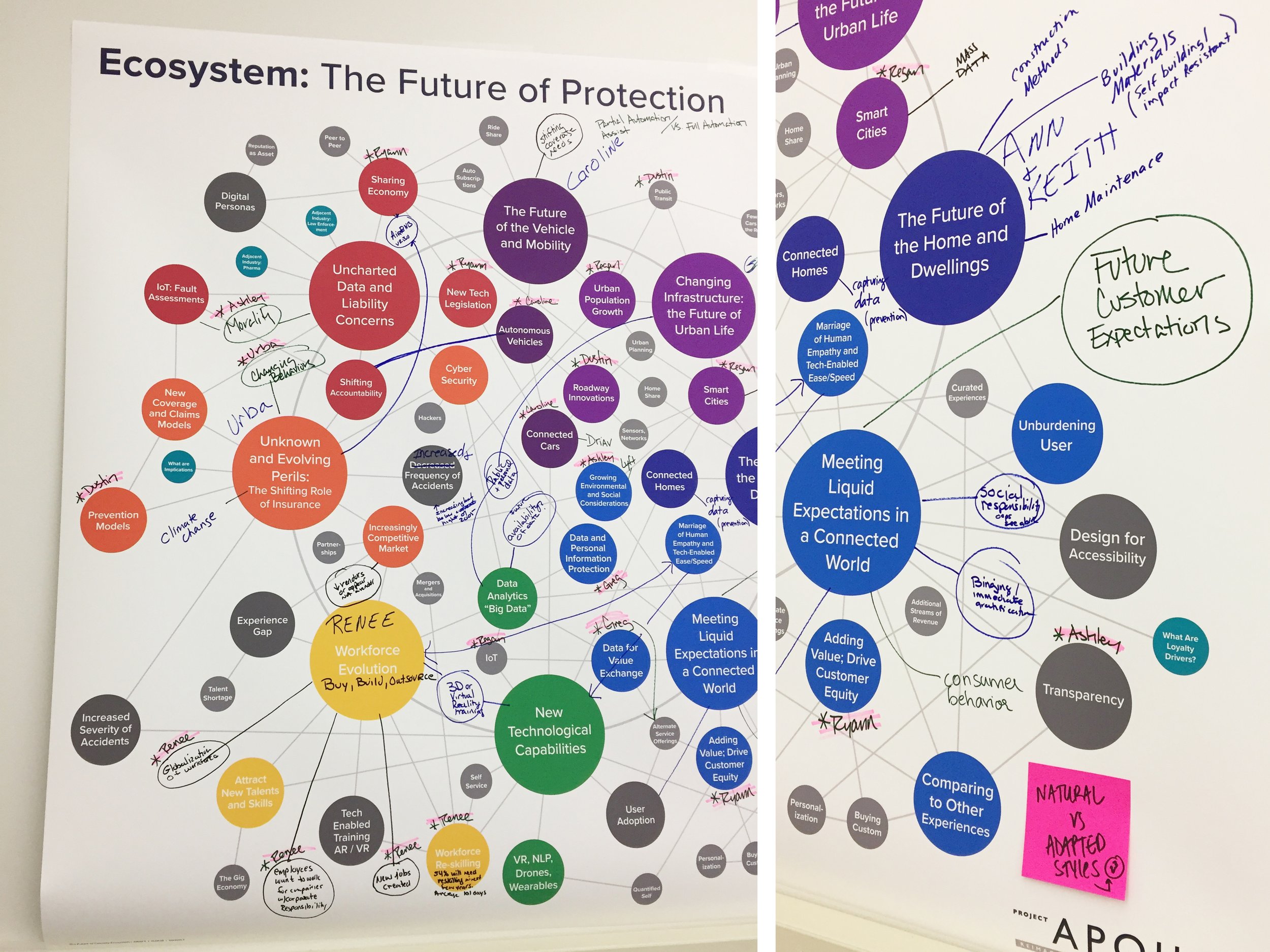

The leadership I brought to the team was a sink-or-swim master class in design. Together, we went way past design thinking, using foresight and product design to imagine new ways to meet user needs with emerging technologies.

Like concept car designs that inspire changes in automotive manufacturing operations, these futuristic claims handling experiences helped us design a more resilient insurance technology platform. With our vision clearly defined, my team and I created an implementation roadmap, translating our vision into actionable steps for transformation.

Our first concept to progress from vision to reality, was a tech-enabled 'claims engine.' Developed into a solution called 'Fabric,' it was designed to create a market-leading claims experience for American Family Insurance. Pictured: the mental model I created to communicate the concept of the ‘claims engine’.

The Story: Securing Buy-In by Design

Challenge #2: Get the buy-in and corporate alignment required for true transformation.

Without buy-in, great ideas crumble. To address the second challenge, I created a communication plan that used mental models, sci-fi and futuristic cartoons. This creative approach helped bring our vision to life for stakeholders and decision-makers who hadn’t been part of the design process.

To communicate the requirements of the claims infrastructure we envisioned, I created 'mental models'—visual diagrams that showed how data flowed through the system, the connections between different workflows, and the roles of the people involved.

With the operational vision mapped out, I had the team write a collection of short stories that featured claims across all lines of business — science fiction with a distinctly insurance bent. By sharing stories of autonomous car accidents and proactive hurricane evacuations, we showed the futuristic claims handling experiences we designed.

To strengthen connection with our audiences, I hired illustrator Andrew Bernier to breathe life into the ‘claims engine’ featured in our stories.

With the deadline fast approaching, there wasn’t time to onboard a graphic designer. I called on my background in layout, rolled up my sleeves, and created a compelling slide deck for the board presentation. I also designed a magazine detailing our vision, roadmap, and story elements as a printed takeaway that could answer outstanding questions.

This effort paid off; armed with our materials, the claims leader who asked for my help secured buy-in during the board meeting. He successfully overcame internal resistance and achieved consensus to proceed with the digital transformation outlined in our vision.

-

These ghostly claim helpers represent our tech-enabled 'claims engine' in action across various claims situations set in 2030, a decade after we created our vision.

-

Digital transformation can be painful and expensive; worse, it's boring to talk about. We needed to communicate our vision to the organization in a way that got everyone enthusiastic about the future we could unlock through digital transformation.

By engaging our audience with visuals and stories, we gave our senior leaders and teams the motivation they needed to implement the vision we created for claims.

I have no way of knowing, and yet I wouldn’t be surprised if these illustrations delivered the largest ROI of the entire project.

-

Our vision for the future of American Family Insurance claims captures a forward-thinking approach that not only addresses current challenges but also prepares the company for future adaptability and success.

In implementing our vision, we will revolutionize claims handling through a flexible, innovative technology platform that empowers adjusters, enriches customer interactions, streamlines workflows, and supports continuous improvement.

UX Strat USA Conference

Insurance AI and Innovative Tech Conference

Digital Insurance Connect

The Impact: Unlocking Opportunities in Insurance

Leading the future of claims visioning project significantly impacted my career, providing opportunities for growth and recognition in the insurance industry.

This work showcased my skills in visionary business strategy and my ability to drive change within a large organization. The connections I made broadened my understanding of the insurance industry's complexities and the role of design in shaping its future.

The project's success led to my selection to lead the strategy design vertical at AFICS, Inc. (the standalone claims company formed by American Family Insurance during its digital transformation). This move allowed me to nurture the innovative culture shift initiated by our vision and create new-to-market insurance value using advancing technology.

Additionally, I was given the responsibility to build American Family Insurance’s reputation for innovation. With executive encouragement, I began speaking about my work at AmFam at industry events.