#ForesightInAction #DesignForChange #DesignScalesBusiness

Designing Claims Transformation

Vision, Buy-in, and Multimillion Dollar Impact

The Situation

After four acquisitions, American Family Insurance was operating five distinct claims processes across multiple technology platforms.

Costs were compounding with every system refresh. Adjusters were juggling five workflows, switching tabs between interfaces at every turn. Innovation was stalling amid confusion about where (and how) to integrate new solutions.

One claims leader came to me and said:

“I need a strategic vision for the future of claims, a plan to present to the board in four months. I’ve heard good things about design. Can you help?”

It was a high-risk, high-impact ask.

Previous efforts had failed by anchoring to existing benchmarks and “best practices” rooted in current-state thinking. I planned to start somewhere more resilient: with a view of the future of risk and business-to-consumer interaction.

Not just plausible scenarios, but a spectrum of possibility designed to inspire visionary solutions built to flex and adapt as the world changed.

“Great claims experiences matter. But the real win is building the organizational muscle to anticipate and create the next one.”

— Ryann Foelker, Connected Claims Conference 2023

The Tension

I had just four months to turn a vague mandate into something fundable at the board level.

And we weren’t just facing skepticism. We were up against a deep-seated culture of stewardship where protecting traditional business functions was seen as a virtue, not a blocker.

The toughest barrier wasn’t technical. It was belief.

We had to create a vision so clear, so tangible, that executives across disciplines and lines of business could see it, feel it, and choose to pursue it together.

“The challenge isn’t just operational, it’s philosophical. We have to move from optimizing what exists to designing for what’s coming.”

— Ryann Foelker, Insurance AI and Innovative Tech Conference 2023

The Work

I led a cross-functional team through a strategic design process guided by foresight, not just frameworks.

We reimagined claims experiences from every angle, then designed the infrastructure to support them before delivering a persuasive, memorable pitch that moved the board to act.

-

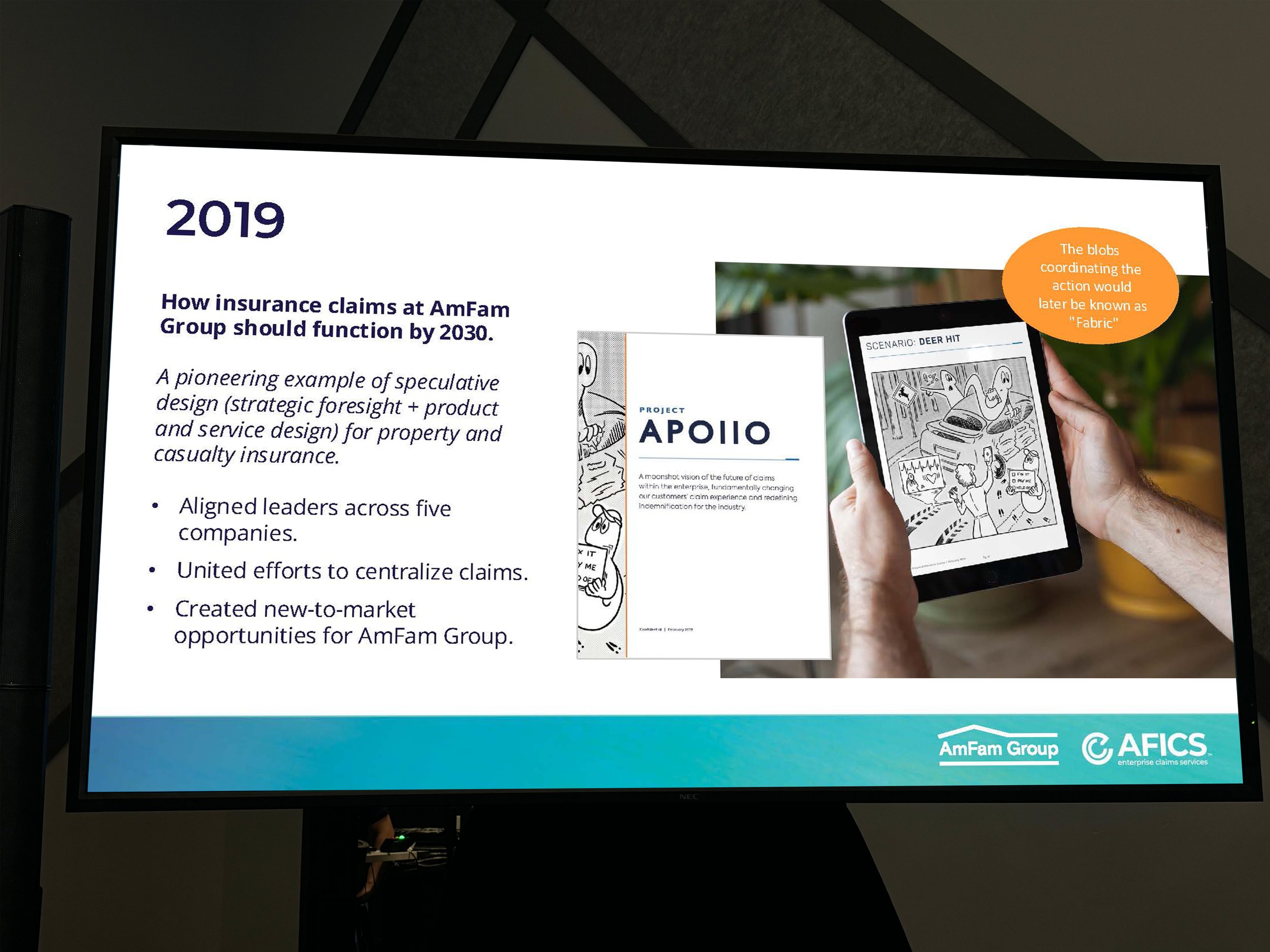

We used foresight to define what claims should look like 10 years out, across tech, people, and process. We imagined autonomous vehicle crashes, proactive hurricane evacuations, AI-enabled empathy (yes, this was in 2019). Then we reverse-engineered the infrastructure that would make that future possible.

-

We sketched a tech-enabled claims operations model that balanced customer empathy, adjuster support, and cost efficiency. This was a true marriage of operational fluency and long-range vision, designed to deliver both business impact and human value.

-

First, we built a clear, staged roadmap that outlined how the organization could evolve toward its future state. Second, we created a mental model of the tech infrastructure: a blueprint that showed how platforms, solutions, and data would need to interact to support that future. Both were clear enough to align around, and practical enough to build from.

-

To bring the vision to life, we created a communication strategy that used speculative storytelling: short sci-fi narratives featuring futuristic claims scenarios from climate disasters to AI-enabled repair logistics (again, this was 2019). We paired those stories with cartoon-style illustrations of “claims engine” we envisioned, a solution later named Fabric.

This wasn’t another deck forecasting more IoT loss prevention. It was a bold, original plan for a more supportive, scalable, and human-centered future, told in a way people could see, feel, and choose to believe in.

The Results

Millions in Annual Expense Savings

We cut over 20% in operational expenses by unifying vendors and platforms, a durable competitive advantage as others tried to catch up.

Accelerated Decision-Making and Execution

With buy-in secured, leadership greenlit tech consolidation. We became the first top 20 carrier to operate on a unified claims platform.

Strategic Credibility and Cultural Change

The work landed us on Fast Company’s Best Workplaces for Innovators and gave design and foresight a permanent seat at the strategy table.

Innovation Pipeline and Strategic Partnerships

We launched Demo Days, a vendor evaluation program that aligned innovative claims solutions to our roadmap, driving multiple pilots and long-term partnerships.

“We didn’t chase recognition, we chased what was possible. This award reminds us that design doesn’t just shape great experiences, it shapes the business decisions behind them.”

— Ryann Foelker, Best Workplaces for Innovators Awards Reception 2023

Why It Worked

Because we didn’t start by asking “What’s broken?”

We asked: “What should the future of claims feel like?”

And then we designed the system — people, platforms, and partnerships — to make that future real.

This case study reflects work I was proud to contribute to at American Family Insurance. The content shared here is based on initiatives that were made public under executive direction and have been featured in industry presentations and publications since 2021. All views expressed are my own. No confidential or proprietary information is disclosed, only publicly available outcomes, personal insights, and individual learnings.