#HumanCenteredAI #DesignDrivesGrowth #DesignScalesBusiness

Designing Human-Centered AI

Personalization, Trust, and Industry Recognition

The Situation

By late 2023, generative AI had officially taken over the conversation in insurance, but nearly every pitch boiled down to faster quotes and lower costs. It was all efficiency, all the time.

But I saw a different opportunity: What if we used AI not to automate humans out of the process, but to amplify what they do best?

At American Family Insurance, I challenged my team to explore how generative AI could help people feel more supported and in control when it comes to their insurance. One team member, Monica Gengler, focused on the personal insurance review: a moment full of potential, yet often under-leveraged.

These reviews are meant to be proactive check-ins that strengthen coverage and deepen the bond between customer and agent. In practice, they’re often inconsistent, time-consuming, or repurposed to explain rate increases.

The question wasn’t just “Can AI speed up the review process?”

It was: “Can AI help people feel more connected and confident in their insurance coverage — at scale?”

“When generative AI showed up, it was like a magic wand. Why waste that power shaving minutes off workflows when we could use it to strengthen financial confidence at scale?”

— Ryann Foelker, GenAI in Insurance Conference 2024

The Tension

Most insurers were treating AI like a silver bullet: a one-size-fits-all solution for ballooning costs and sluggish cycle times.

Meanwhile, customers were overwhelmed, agents were overworked, and far too many households were underinsured. Left unchecked, we were on track to make outdated experiences faster, not better.

So I gave my team a six-week Design Challenge: Start with AI’s capabilities – current and projected. And use them to design for the customer, not just the business.

“AI agents don’t replace trust. They create the space for bonds to scale.”

— Ryann Foelker, ITC Vegas 2024

The Work

This wasn’t a design-thinking brainstorm. It was a blueprint for strategic capability-building.

I led my team through a structured process that treated GenAI like any other emerging material — something to be studied, experimented with, and ultimately wielded with care.

Our guiding principles:

Tech-first, problem second: We explored GenAI’s mechanics before mapping customer pain points, giving us both inspiration and a realistic lens on feasibility.

Human-in-the-loop by design: We built for agents, not to replace them, but to augment their role as trusted advisors in risk and protection.

Concepts with heart and teeth: We focused on financial confusion, missed coverage, and trust erosion, not just quote speed or claims automation.

Pitch-ready, pilot-worthy: Seven original concepts emerged. All were scoped for near-term testing and long-term scalability.

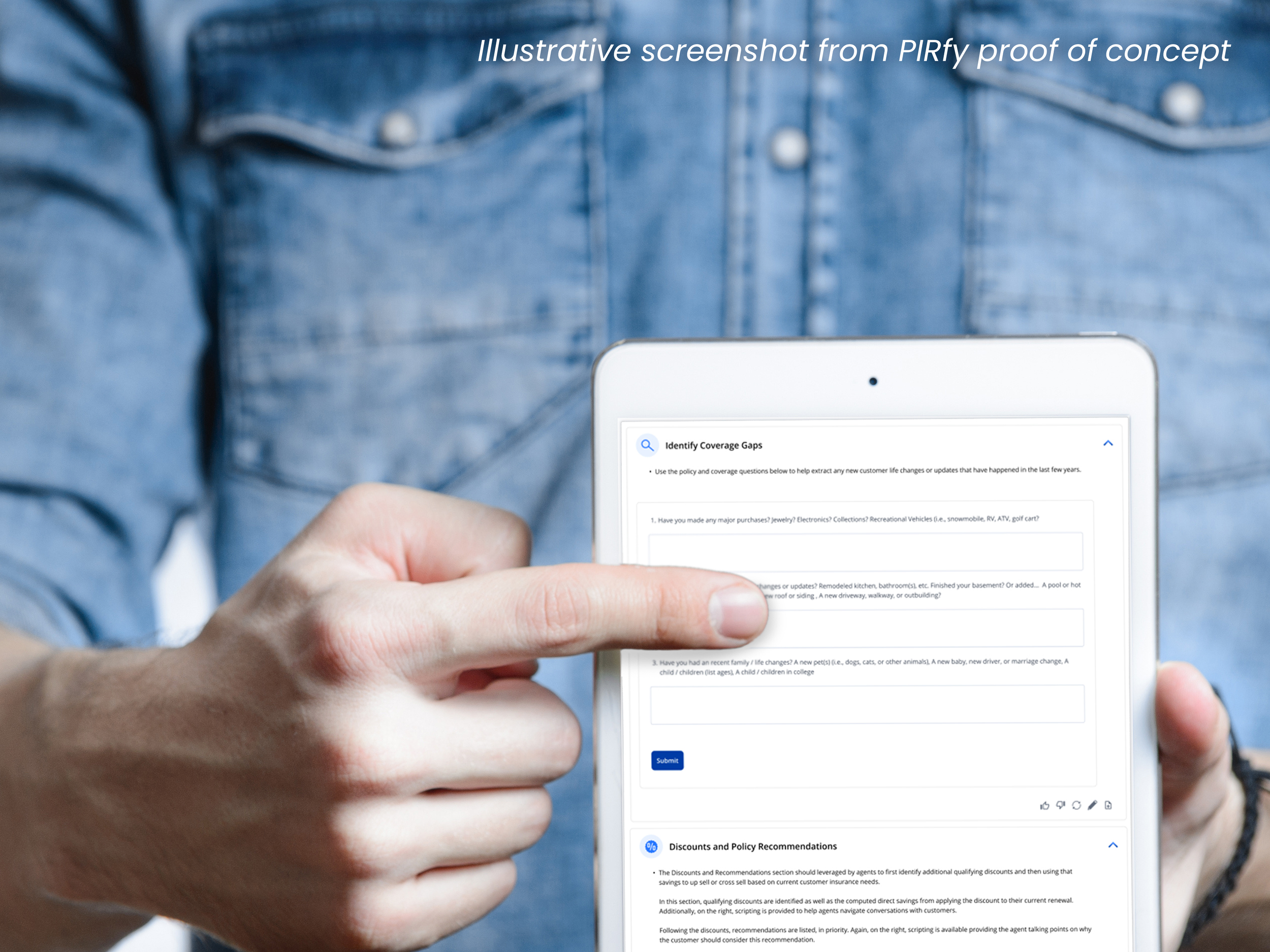

Two concepts moved to proof-of-concept, and one, PIRfy, was selected for immediate development.

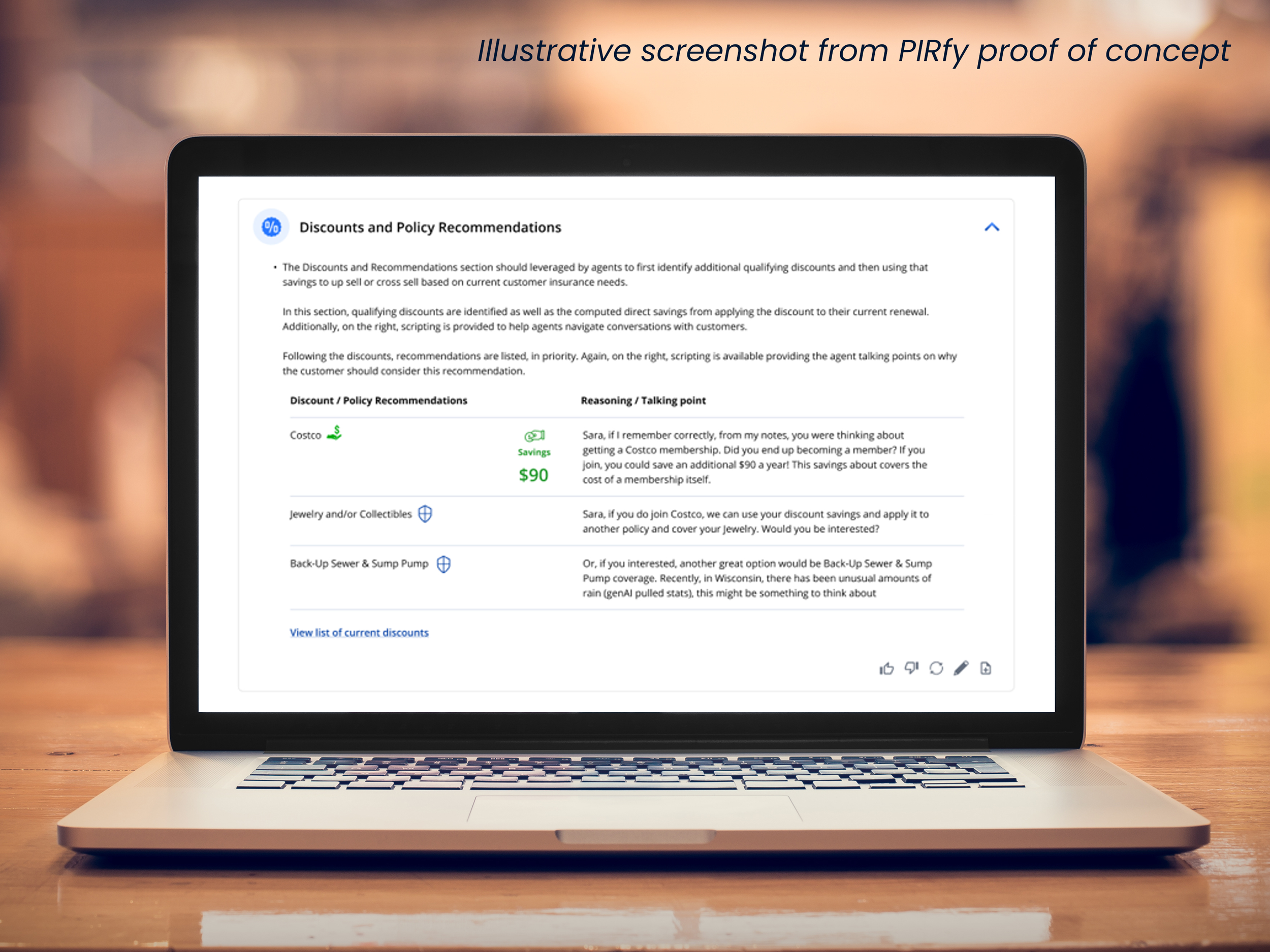

PIRfy (Personal Insurance Review for You) is a GenAI-powered assistant that helps agents prep for coverage reviews with consolidated insights, personalized scripts, and coverage-calibrating prompts — all delivered directly through their existing CRM workflow.

It wasn’t purchased off the shelf. We designed it in-house, with continuous input from AmFam agents — making it one of the only GenAI tools in the industry built by a carrier, for its people. The IP is AmFam’s, from concept to experience.

It’s not just faster. It’s smarter. And it’s already reshaping how we think about what’s possible in insurance.

The Results

Designed for Scale and Revenue Lift

By cutting over 30 minutes of prep time per review, PIRfy is projected to more than double review volume, enabling personalized coverage conversations for customers who might otherwise remain underinsured and unaware of their risk.

Agents in early testing called PIRfy “a grand slam for retention” and “the most excited I’ve been in a long time.” One even asked, “Can we have this tomorrow?” That’s not just enthusiasm, it’s early evidence of a solution designed to drive behavior change at scale.

If fully adopted, PIRfy is positioned to deliver substantial business value through:

Retention gains, by improving outreach quality and timing

Cross-sell growth, by surfacing relevant protection opportunities

Significant time savings, freeing agents to deepen relationships and reach more households

Improved coverage outcomes, with tens of thousands more customers receiving tailored reviews each year

With continued investment in this human-centered (lovable) direction, PIRfy could unlock multimillion-dollar impact annually. Not just through efficiency, but through stronger trust, protection, and personalization at scale.

2024 Insurer Innovation Award – Americas Region

PIRfy earned top honors from The Digital Insurer, beating out global finalists from AXA and RBC. Judges recognized its potential to close the protection gap at scale by improving customer awareness of financial risk and coverage needs.

More than a product win, it validated our team’s ability to design AI that’s both strategic and human; and lead that capability on behalf of the enterprise.

Strategic Co-Development Partnership with Deloitte

Our portfolio of GenAI concepts led to a co-development agreement with Deloitte Digital, a direct result of industry interest in our design-led approach. One Deloitte partner described PIRfy as “the most exciting thing happening with AI in insurance;” not just because of the technology, but because of the clarity of vision and human-centered execution behind it.

This wasn’t a pitch. It was a pull, a recognition that the way we were designing AI wasn’t just novel. It was valuable.

Reuters Trailblazing Women in Insurance

This body of work earned me recognition from Reuters as one of the industry’s Trailblazing Women in Insurance; not just for what I built, but for how I led: with vision, originality, and a bias for scaling readiness, not just output.

“We didn’t just advocate for a minimum lovable product; we helped prove its potential. PIRfy uses the agent as the human-in-the-loop today, but it’s built to scale trust and personalization across every channel tomorrow.”

— Ryann Foelker, The Digital Insurer Awards 2024

Why It Worked

Because we built it with intention, not just invention.

We designed AI as a delivery system for personalized support, not a workaround for cost-cutting.

We developed a lovable product, not just a functional one.

And we developed talent, not just tools, turning a learning experience into an engine for enterprise innovation.

“This work didn’t just produce an award-winning product. It built the team, process, and partnerships to scale design as a business function.”

— Ryann Foelker, Insurance Innovators Conference 2025

This case study reflects work I was proud to contribute to at American Family Insurance. The content shared here is based on initiatives that were made public under executive direction and have been featured in industry presentations and publications since 2024, including The Digital Insurer’s World’s Digital Insurance Awards. While I reference my work in innovation and design at AmFam, this content draws on publicly shared concepts, case studies, and my individual learnings, not corporate or trade-secret strategies. Recognition mentioned (e.g., industry awards or press coverage) is publicly available and is used here to illustrate broader themes in innovation and design leadership. All views expressed are my own. No confidential or proprietary information is disclosed, only publicly available outcomes, personal insights, and individual learnings